mississippi tax and tag calculator

If you are unsure call any local car dealership and ask for the tax rate. Its fairly simple to calculate provided you know your regions sales tax.

Mississippi Car Registration Fees.

. DeSoto County Geographic Information System GIS. Mississippi Department of Revenue Motor Vehicle Licensing Bureau Post Office Box 1140 Jackson MS 39215-1140 Apportioned Tags. 2000 x 5 100.

The county the vehicle is registered in. Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. Enter the valuation from your last tag receipt.

This is only an estimate based on the current tax rate and the approximate value of the property. Mississippi Documentation Fees. Tax and Tags Calculator.

Mississippi has a 7 statewide sales tax rate but also has 142 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0065 on. Mississippi Property Tax Calculator - SmartAsset. The mississippi ms state sales tax rate is currently 7.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. These fees are separate from. The tax assessor has a Tax Calculator to help you estimate the cost of your property taxes.

Mississippi Salary Tax Calculator for the Tax Year 202122. Once you have the tax rate multiply it with the vehicles purchase price. Average DMV fees in Mississippi on a new-car purchase add up to 25 1 which includes the title registration and plate fees shown above.

You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. Mississippi state rate s for 2021. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. International Registration Plan IRP Laws and Regulations. Motor Vehicle Ad Valorem Taxes.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122. Enter the Manufacturers Suggested Retail Price. Details of the personal income tax rates used in the 2022 Mississippi State Calculator are published below the.

- Select this method for used vehicles where the Purchase Price is known. Dealers Motor Vehicle Assessments Motor Vehicle Tax Law Mississippi Code at Lexis Publishing Title 63 Chapter 21. Is Life Insurance Taxable Forbes Advisor.

Enter the purchase price. You can do this on your own or use an online tax calculator. The per capita income is 21388 the median household income is 43328 and 256 of the persons in Lafayette County are considered below poverty level.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Select the model year. 2021 Tax Appraisal Data.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. And if you come to Mississippi from Illinois Hawaii Tennessee Florida or any of the other 20 states that charge no taxes on car tags that can be quite a shock. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Dealership employees are more in tune to tax rates than most government officials. - Select this method if you have your last tag receipt. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

1000 - If the Tax Collectors Office completes the Title Application 300 - Mail fee for tag and decal 5 - Use Tax if the vehicle is purchased from an out of state dealer. Please fill out the form below and click on the calculate button. Our calculator has been specially developed.

Mississippi tax and tag calculator. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Motor Vehicle Registration and Title.

Car Tag Prices Vary Across The State

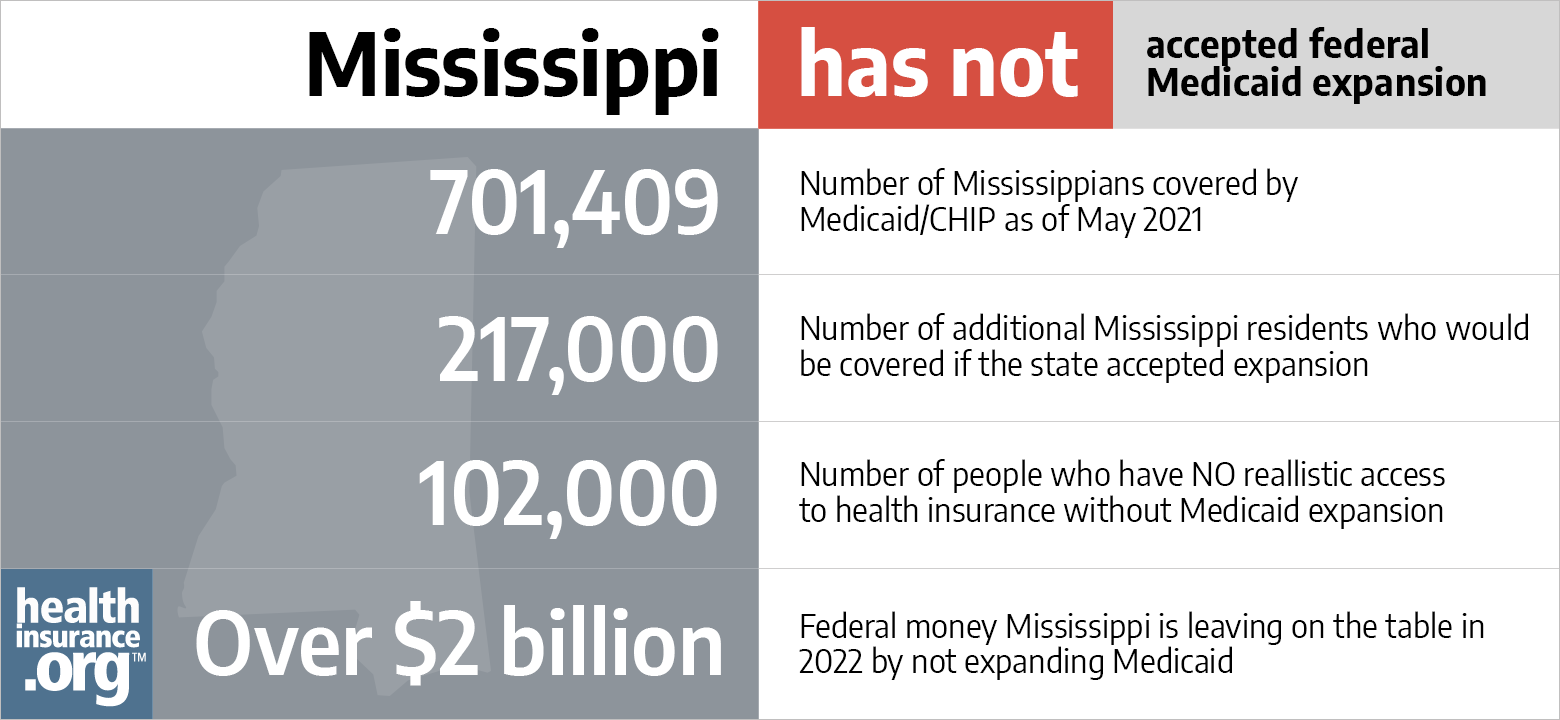

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org

How To Do A Mississippi Dmv Change Of Address Moving Com

Mississippi License Plates Are Sometimes Expensive Due To Local Proper

How To Register A Car In Mississippi Yourmechanic Advice

Estimate Your Car Payment Cannon Nissan Of Oxford

Sales Tax On Cars And Vehicles In Mississippi

Minnesota Map Moved Minnesota State Minnesota Moorhead Minnesota

Mississippi Sales Tax Calculator Reverse Sales Dremployee

Cost Of Invisalign In Mississippi Smile Prep

Mississippi State Tax H R Block

Car Tax By State Usa Manual Car Sales Tax Calculator

Mississippi State Ifta Fuel Tax File Ifta Online Ifta Tax

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog